Understanding Multi-Factor Authentication

Have you ever been asked to enter a code sent to your phone or email address after typing in your password? If so, you’ve already had a glimpse of something called Multi-Factor Authentication, or MFA. Let’s break down what this is, why it matters, and where you’ll see it in action.

What Is MFA?

Multi-Factor Authentication is a security method that requires more than one form of identification to access an account. Instead of relying on just your password, MFA adds one or more additional “factors” that help prove you’re really you.

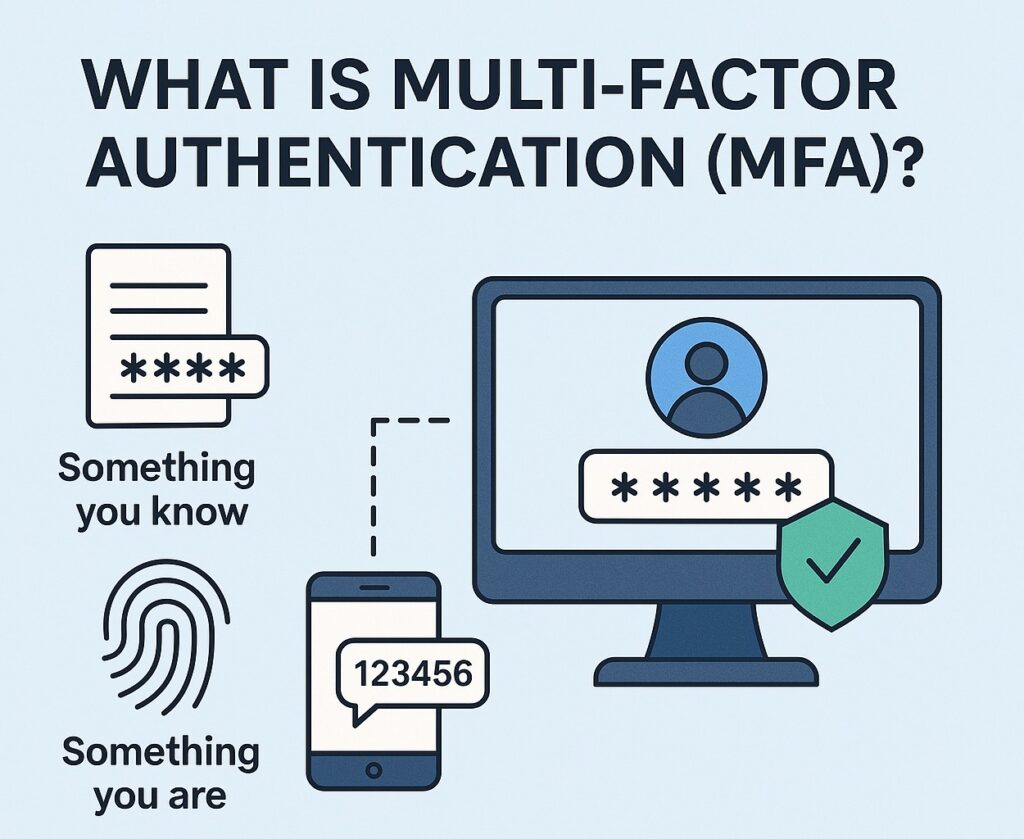

There are generally three types of factors:

- Something you know – like a password or PIN.

- Something you have – like a phone, security token, or app.

- Something you are – like a fingerprint or facial recognition.

To get into an account protected by MFA, you usually need at least two of these. For example, after entering your password (something you know), you might need to enter a code sent to your phone (something you have).

Why Is MFA Important?

Passwords can be guessed, stolen, or leaked in data breaches. MFA adds an extra layer of protection so that even if someone gets your password, they still can’t get into your account without that second factor. MFA helps prevent identity theft, unauthorized account access, financial fraud, email hijacking, and phishing attacks. In short, MFA makes it much harder for scammers to succeed, which is why cybersecurity experts recommend it for everything from email accounts to banking apps.

Where Will You See MFA?

MFA is becoming more common every day. You may have seen it while using email services (like Pineland.net email), online banking platforms, social media platforms, shopping sites, and work accounts. Often, you’ll get a one-time passcode via text message, authenticator app, or email, or you’ll be prompted to use your fingerprint or face scan.

Turning on MFA might add a few seconds to your login process, but it’s worth the peace of mind. In a world where cyber threats are on the rise, this small extra step can make a huge difference in protecting your personal and financial information. So next time you’re given the option to enable MFA—say yes!